When Corporations Kill: The Deadly Mathematics of Profit Over People

The most chilling corporate documents ever uncovered aren’t hidden in some shadowy conspiracy – they’re filed in court records, sitting in plain sight for anyone willing to look. These documents reveal a systematic pattern across decades and industries: major corporations routinely calculate that it’s cheaper to pay compensation for deaths and injuries than to fix dangerous products. This isn’t speculation or conspiracy theory – it’s documented corporate policy, backed by internal memos, cost-benefit analyses, and executive testimony that puts a literal price tag on human life.

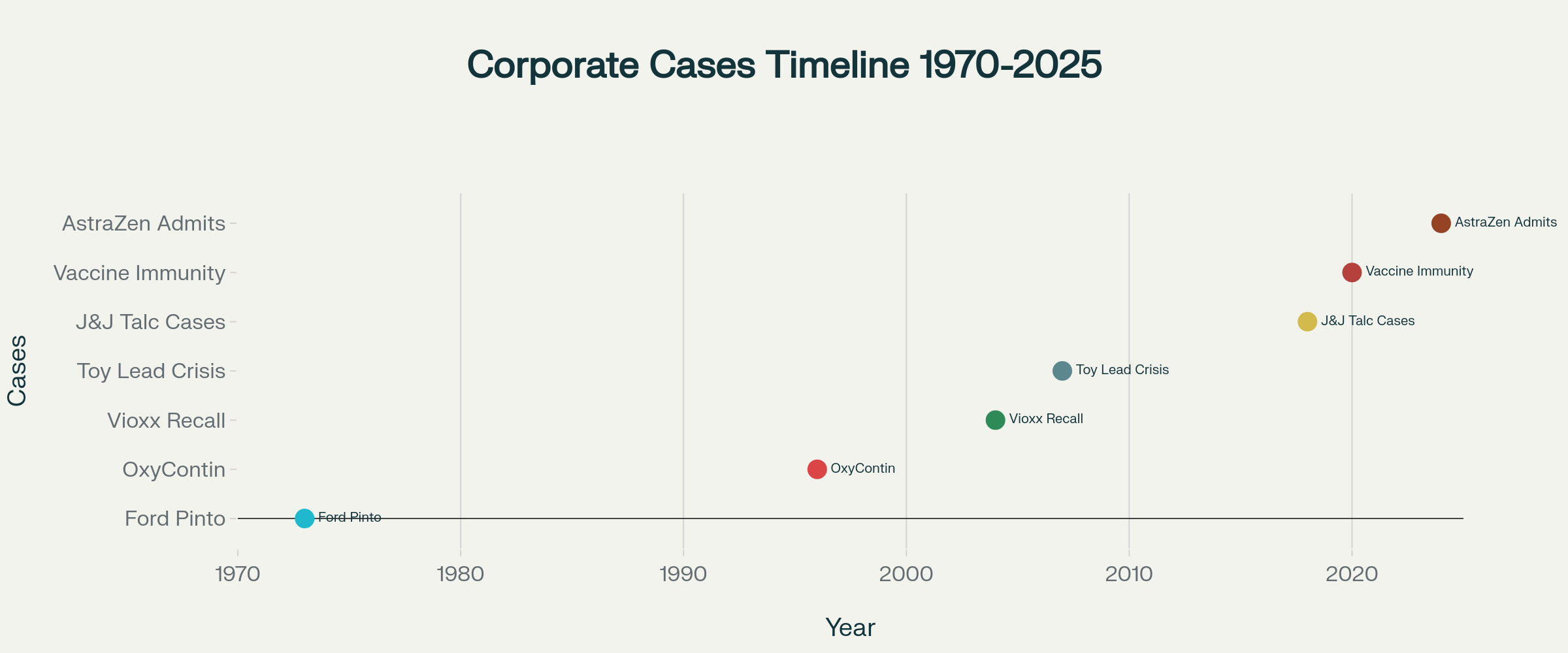

Timeline of Major Corporate “When Corporations Kill” Cases – Showing decades of prioritizing profits over lives

The Ford Pinto: Ground Zero for Corporate Callousness

The case that exposed this murderous mathematics began in 1973 with Ford Motor Company’s internal memo titled “Fatalities Associated with Crash Induced Fuel Leakage and Fires.” This document, which became known as the “Pinto Memo,” would become one of the most notorious corporate documents in American history. Ford engineers had discovered that the Pinto’s fuel tank was dangerously positioned behind the rear axle, making it vulnerable to rupture in rear-end collisions. The fix was simple: an $11 safety modification per vehicle.

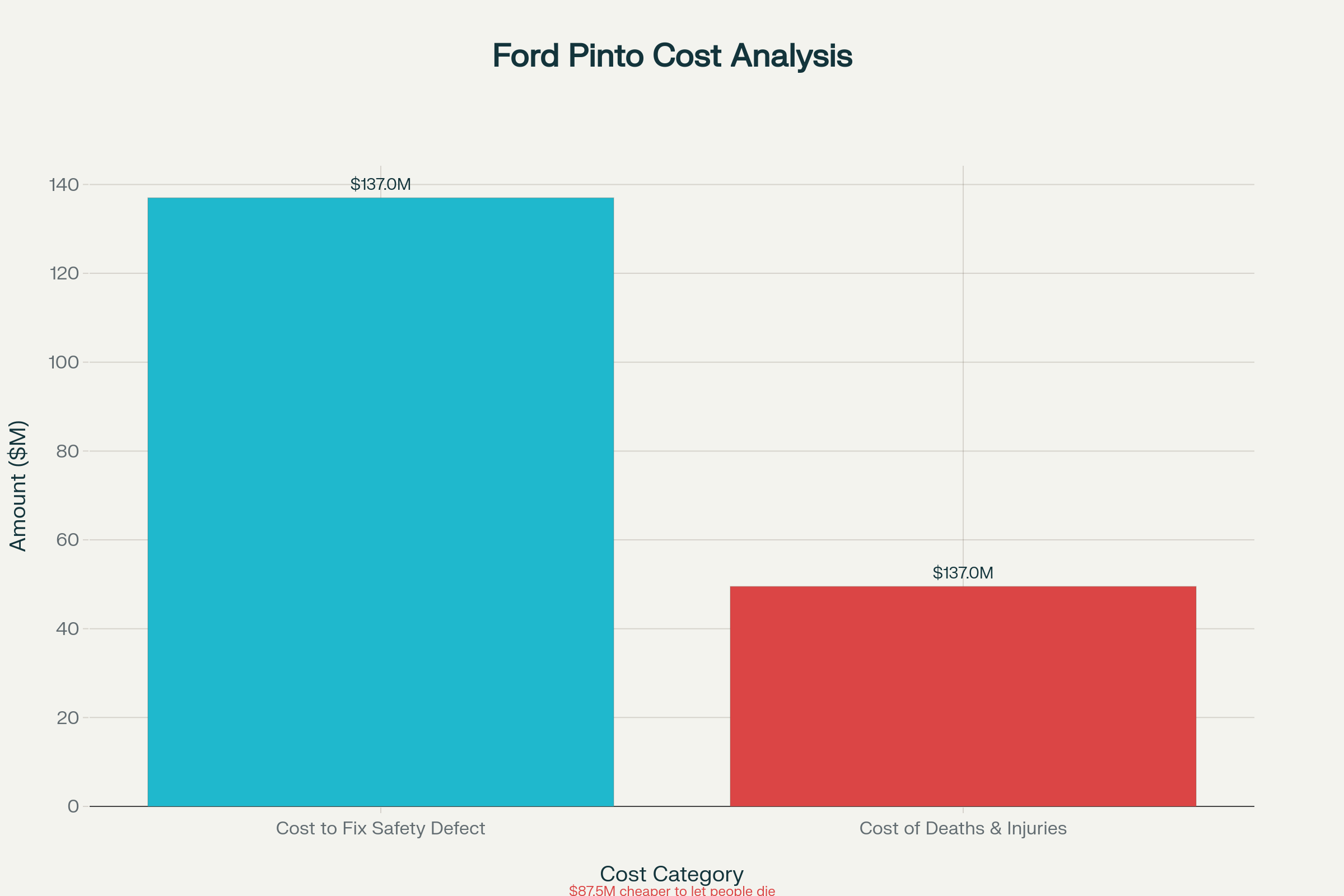

But Ford didn’t implement the fix. Instead, they did the math. The company calculated that fixing 11 million cars would cost $137 million, while paying compensation for the expected deaths and injuries would only cost $49.5 million – a net savings of $87.5 million. The memo coldly assigned monetary values to human suffering: $200,000 per death, $67,000 per serious injury, and $700 per burned vehicle.

Ford Pinto Cost-Benefit Analysis – Corporate calculation showing it was $87.5 million cheaper to let people die

Ford’s calculations were both morally repugnant and mathematically flawed. The company dramatically underestimated injury rates, claiming burn injuries would equal burn deaths when experts knew the ratio was 10:1. They used artificially low valuations for human life – the National Highway Traffic Safety Administration recommended $275,000, while other federal agencies used $350,000. Ford also inflated the cost of repairs, claiming $11 per vehicle when third-party companies offered solutions for under $5.

The real tragedy extends beyond the numbers. According to various estimates, between 500 and 900 people died in Pinto fires that could have been prevented with Ford’s knowledge. The company continued production for eight years, from 1970 to 1978, knowing their vehicles were “death traps” and “fire traps”.

GM’s “Side-Saddle” Death Trap (1973-1987)

GM’s 1973-1987 C/K pickup trucks had “side-saddle” fuel tanks mounted outside the frame rails on the sides of the vehicle. This design made the tanks extremely vulnerable to side-impact crashes, and the results were catastrophic.

The Death Toll:

More than 20 times as many fatalities as the Ford Pinto

Risk of burning to death in side-impact crashes was 3.4 to 6 times higher than comparable Ford and Dodge pickups

GM Knew It Was Deadly From The Start

Internal GM documents reveal the company knew about the danger from day one:

- 1970: GM engineer George Carvil warned of fuel leaks in side collisions, writing “Moving these side tanks inboard might eliminate most of these potential leakers”

1972: GM engineers recommended shields around the tanks for protection

1983: Internal memo discussed relocating tanks “inside the frame rails” as “a much less vulnerable location”

Even Chrysler engineers rejected this design, specifically stating: “A frame mounted fuel tank anywhere outside the frame rails would be in a very questionable area due to the new Federal Standards requiring 15 MPH side impacts… Any side impact would automatically encroach on this area and the probability of tank leakage would be extremely high”.

The Same Corporate Murder Math

Just like Ford, GM did their own cost-benefit analysis. GM engineer Edward Ivey concluded it wasn’t cost-effective to spend more than $2.20 per vehicle to prevent a fire death. When deposed about this calculation, Ivey was asked if he could identify a more hazardous location for the fuel tank. His response? “Well yes… You could put it on the front bumper”.

The Government Cover-Up

In 1994, Transportation Secretary Federico Pena initially determined the GM trucks had a safety defect and accused GM management of having “made a decision favoring sales over safety”. But GM applied massive political pressure, including a direct appeal to President Clinton.

The result? GM never recalled a single truck. Instead, they cut a deal with the Clinton administration for $51 million in “safety programs” – no actual fix for the deadly trucks.

The Scope of GM’s Betrayal

GM continued using dual side-saddle tanks, doubling the risk by having fuel tanks on both sides

A protective steel cage cost only $23 but GM refused to install it

GM crash tests showed the tanks “split like melons” in impacts

The Pharmaceutical Industry’s Deadly Deceptions

OxyContin: Addiction by Design

The opioid crisis that has killed over 400,000 Americans since 1999 began with Purdue Pharma’s calculated deception about OxyContin. When the FDA approved OxyContin in 1995, Purdue was allowed to claim the drug was “believed to reduce” abuse potential compared to shorter-acting opioids – a claim based on theory, not clinical trials.

Purdue transformed this limited FDA language into a massive marketing lie. The company trained sales representatives to tell doctors that OxyContin had “less than 1% addiction risk,” citing a five-sentence letter published in the New England Journal of Medicine about hospital patients – a study completely irrelevant to long-term chronic pain treatment. The letter’s author later expressed deep regret, saying he would never have published it if he knew how it would be misused.

Internal Purdue documents reveal the company knew OxyContin was highly addictive from the start. By 1996, just five months after approval, executives received reports about users crushing and injecting the pills. The company discovered that 68% of oxycodone could be extracted from crushed tablets, yet continued marketing the drug as abuse-resistant. Sales exploded from $44 million in 1996 to nearly $3 billion by 2001.

The human cost was catastrophic. Studies show addiction rates in chronic pain patients taking opioids range from 12% to 45%, not the “less than 1%” Purdue claimed. The company eventually pleaded guilty in 2007 to criminal charges of misbranding OxyContin and paid $634 million in fines, but by then the damage was done – an entire generation addicted to opioids.

The Vioxx Scandal: Hearts Stopped for Profit

Merck’s handling of Vioxx (rofecoxib) represents perhaps the most deadly pharmaceutical cover-up in history. The arthritis drug, approved in 1999, was known to cause heart attacks and strokes, yet Merck concealed this information while aggressively marketing the medication to millions of patients.

Internal Merck documents show the company was aware of cardiovascular risks as early as 2000, when cardiologists published warnings in the Journal of the American Medical Association. Merck dismissed these concerns and even requested that safety information be kept from the public. The company didn’t add heart attack warnings to labels until 2002, and only recalled Vioxx in September 2004 after overwhelming evidence made denial impossible.

The human toll was staggering. Studies suggest that between 88,000 and 140,000 Americans suffered heart attacks due to Vioxx, with 30-40% of these being fatal. A Kaiser Permanente analysis of 1.4 million patient records found approximately 27,785 heart attacks and sudden cardiac deaths that may not have occurred without Vioxx. Despite this carnage, Merck initially fought every lawsuit, claiming the drug was safe.

The company eventually settled around 60,000 lawsuits for $4.85 billion in 2007, followed by another $950 million in criminal and civil penalties to the Department of Justice in 2011. Merck pleaded guilty to a misdemeanor charge for introducing a misbranded drug into interstate commerce, paying a $321 million criminal fine.

The Poisoning of Children: Lead Paint and Asbestos Scandals

Chinese Toy Crisis: When Profit Trumps Child Safety

The 2007 Chinese toy recalls exposed how global supply chains can hide deadly cost-cutting measures. Mattel, the world’s largest toymaker, recalled nearly 20 million toys due to lead paint contamination – toys that poisoned children while executives calculated the costs of safety versus the costs of compensation.

The recall crisis began in June 2007 when RC2 Corp recalled Thomas & Friends train sets for excessive lead paint. Mattel followed in August with massive recalls of Fisher-Price toys, including popular Dora, Diego, and Sesame Street products. Lead levels were so dangerous that any exposure could cause brain damage in children.

What made the scandal more outrageous was that Mattel had worked with some Chinese suppliers for 15 years and had praised their “exemplary product safety systems”. Yet the company admitted it didn’t test every toy before sale, relying on suppliers to self-police. When asked about consumer trust, a Mattel executive could only say: “clearly, we’ve let the consumer down”.

The European Commission noted that over 1 million toys were pulled from German shelves alone, with millions more recalled across Britain, Ireland, and other countries. One Chinese factory produced 83 different types of toys painted with lead pigment. The scandal highlighted how manufacturers could poison children worldwide while hiding behind complex supply chain arrangements that diffused responsibility.

Johnson & Johnson: Decades of Asbestos Denial

Perhaps no case better illustrates the depths of corporate deception than Johnson & Johnson’s talcum powder scandal. Internal company documents dating to 1969 show J&J knew its baby powder contained asbestos – a deadly carcinogen – yet continued selling the product for decades while publicly denying any danger.

Court documents reveal J&J routinely tested its talc for asbestos contamination and found positive results multiple times between 1970-2000. A 1969 internal memo specifically mentioned test results showing “trace amounts of asbestos” in talc samples. The company chose not to share this information with regulators or consumers, instead marketing baby powder as safe for intimate use by women and children.

The human cost has been devastating. Scientists have linked talc use to ovarian cancer and mesothelioma, with thousands of women developing deadly cancers after decades of using J&J products. A St. Louis jury awarded $4.78 billion to 22 women who developed ovarian cancer from talc use – one of the largest product liability verdicts in history.

J&J has faced over 60,000 lawsuits and spent more than $6 billion trying to settle claims. The company has attempted to use bankruptcy laws to avoid full liability, filing for Chapter 11 three times through subsidiary companies. Federal judges have repeatedly rejected these tactics, forcing J&J to continue fighting cases that expose decades of cover-up.

Agricultural Poisons: The Roundup Cancer Cover-up

Bayer’s acquisition of Monsanto in 2018 came with a $63 billion price tag – and hundreds of thousands of cancer lawsuits claiming Roundup weed killer causes non-Hodgkin lymphoma. Internal Monsanto documents revealed in litigation show a company that spent decades manipulating science and attacking researchers who questioned glyphosate’s safety.

The controversy intensified in 2015 when the International Agency for Research on Cancer declared glyphosate “probably carcinogenic to humans”. Monsanto’s response wasn’t to investigate safety concerns but to launch aggressive campaigns discrediting the World Health Organization and funding studies designed to show safety. Court documents revealed Monsanto’s practice of “ghostwriting” scientific papers that appeared to be independent research but were actually company propaganda.

One of the most damaging revelations was Monsanto’s secret funding of the “American Council on Science and Health” and other front groups that attacked scientists studying glyphosate. The company also worked to influence EPA officials and delay safety reviews. Internal emails showed Monsanto executives celebrating when they successfully prevented further safety studies.

Juries have consistently found Monsanto liable, awarding billions in damages. A Georgia man recently won $2.1 billion after claiming Roundup caused his cancer. The company faces over 60,000 active lawsuits despite spending more than $10 billion on settlements. Bayer is now seeking state laws and Supreme Court intervention to block future cancer lawsuits, arguing federal pesticide regulations should preempt state court claims.

The COVID-19 Vaccine Shield: Corporate Immunity in Action

The AstraZeneca COVID-19 vaccine case represents the newest evolution in corporate immunity from liability. In an unprecedented move, governments worldwide granted pharmaceutical companies blanket legal immunity for COVID vaccine injuries, creating a system where corporations profit while taxpayers bear the costs of adverse effects.

AstraZeneca initially denied their vaccine could cause blood clots and low platelet counts (TTS – Thrombosis with Thrombocytopenia Syndrome). However, in February 2024, the company admitted in court documents that the vaccine “can, in very rare cases, cause TTS”. This admission came only after securing complete legal immunity and government indemnification.

The UK’s Vaccine Damage Payment Scheme offers just £120,000 for severe injuries – an amount unchanged since 2010 and woefully inadequate for lifetime disabilities or death. Meanwhile, families of those injured or killed by vaccines cannot sue manufacturers due to government indemnity agreements. The government effectively socializes the risks while privatizing the profits.

A parliamentary petition calling for removal of vaccine manufacturer immunity gathered over 16,000 signatures but was rejected by the government. Officials argued that indemnities don’t prevent legal claims under consumer protection laws, but in practice, the Consumer Protection Act provides limited remedies compared to traditional negligence claims.

Regulatory Capture: When Watchdogs Become Lapdogs

The pattern of corporate impunity continues because regulatory agencies have been systematically captured by the industries they’re supposed to police. This “regulatory capture” occurs when agencies prioritize industry interests over public safety.

The FDA’s Revolving Door

The Food and Drug Administration exemplifies regulatory capture. A 2023 study found that 32% of departing HHS employees went to industry jobs, with the highest rates at CDC, CMS, and FDA. This “revolving door” means regulators know their future employers may be the companies they currently oversee.

The FDA’s dependence on industry “user fees” creates additional conflicts. Since 1992, pharmaceutical companies have paid fees for drug reviews, giving them direct financial influence over their regulator. Companies negotiate not just the fees but also performance targets the FDA must meet to collect them. This arrangement creates incentives for faster approvals rather than thorough safety reviews.

Former FDA insider Dr. Paul Stolley described the agency as having become “a servant of industry” where dissenting voices are intimidated and scientific debate is repressed. The alosetron case he investigated showed how industry partnerships replaced independent regulation. Similar patterns exist across agencies supposed to protect public safety.

The Cost-Benefit Shell Game

Government agencies and corporations routinely use cost-benefit analyses that treat human life as just another line item in financial calculations. The U.S. Department of Transportation values a statistical life at $13.7 million – a figure used to determine whether safety regulations are “cost-effective”.

These calculations serve to justify inaction rather than promote safety. When Ford calculated Pinto deaths at $200,000 each, they weren’t making an objective assessment but lowballing human value to avoid costly fixes. When pharmaceutical companies conduct cost-benefit analyses for drug safety, they’re weighing profits against lives with the scales tilted toward corporate interests.

The fundamental problem isn’t the concept of cost-benefit analysis but its manipulation by corporations and captured regulators. Public health decisions should prioritize preventing deaths and injuries, not maximizing industry profits. When agencies use industry-friendly assumptions and corporate-funded studies, cost-benefit analysis becomes a tool of corporate power rather than public protection.

The Immunity Shield: Legal Protection for Corporate Killers

Modern corporations have perfected the art of avoiding accountability through legal immunity schemes that shift liability to taxpayers while preserving profits. The COVID vaccine indemnification represents just the latest evolution in this corporate protection racket.

Government Indemnification

Companies increasingly demand government indemnity as a condition of doing business, especially in areas involving public safety. These agreements mean taxpayers cover lawsuit costs while companies keep profits – a system that eliminates financial incentives for safety.

The AstraZeneca COVID vaccine provides a perfect example. The company received blanket immunity from liability while generating billions in revenue. When people were injured or killed by the vaccine, families couldn’t sue the manufacturer but had to rely on inadequate government compensation schemes. The company admitted the vaccine could cause deadly blood clots only after securing complete legal protection.

Similar patterns exist across industries. Defense contractors, nuclear power companies, and pharmaceutical manufacturers routinely demand immunity from liability. Government agencies, captured by industry influence, readily grant these protections while leaving victims without recourse.

Bankruptcy Shield Games

When legal immunity isn’t available, corporations use bankruptcy laws to avoid liability. Johnson & Johnson has repeatedly tried to spin off a subsidiary company, have it declare bankruptcy, and use that proceeding to cap liability for talc-related cancers. Federal judges have rejected these schemes three times, but the company keeps trying.

This “Texas two-step” bankruptcy maneuver allows profitable companies to shed liabilities while protecting assets. Victims are forced into bankruptcy proceedings where they receive pennies on the dollar, if anything, while the parent company continues operations unchanged. It’s corporate three-card monte with people’s lives as the stakes.

International Immunity Shopping

Multinational corporations exploit jurisdictional differences to avoid accountability. They structure operations to claim sovereign immunity, forum shop for friendly courts, and use complex corporate structures to hide assets from judgment.

When Bayer faces Roundup lawsuits in the U.S., it threatens to move operations overseas where regulations are weaker. When Johnson & Johnson faces talc litigation, it attempts bankruptcy in Texas where laws favor corporations. These strategies allow companies to profit from dangerous products while avoiding full accountability for the harm they cause.

Why the System Fails: The Economics of Impunity

The “when corporations kill” phenomenon persists because the current legal and regulatory system makes it profitable. Companies face three potential costs for dangerous products: recalls, litigation, and regulatory penalties. When these costs are lower than fixing safety problems, corporations rationally choose to let people die.

Inadequate Penalties

Civil lawsuit damages, even when substantial, often represent a fraction of corporate profits from dangerous products. Merck paid $4.85 billion to settle Vioxx claims but made far more selling the drug. Johnson & Johnson has spent over $6 billion on talc litigation but generated decades of profits from baby powder.

Criminal penalties are even more inadequate. Purdue Pharma executives paid $634 million in fines for the opioid crisis but made billions creating the addiction epidemic. No executives went to prison despite knowing their marketing was fraudulent. When criminal penalties are just cost of doing business, they become licenses to kill.

Regulatory penalties are often laughably small. The FDA can fine companies, but maximum penalties are far below potential profits from dangerous products. Most “settlements” allow companies to avoid admitting wrongdoing, preserving their reputation while paying what amounts to protection money.

Delayed Justice

Legal proceedings take years or decades, during which companies continue profiting from dangerous products. The Pinto memo was written in 1973 but Ford didn’t recall the car until 1978 – five years of additional deaths and injuries. Vioxx caused heart attacks for years while Merck fought safety warnings.

Class action lawsuits and mass tort litigation can drag on for decades. Johnson & Johnson has been fighting talc cases since the 1990s while continuing to sell products they knew contained asbestos. During litigation, companies generate massive profits while victims suffer and die.

The legal system’s glacial pace serves corporate interests by allowing dangerous products to remain profitable long after their dangers are known. Justice delayed is literally justice denied when people die waiting for corporate accountability.

Regulatory Capture

Perhaps most importantly, the system fails because regulators serve corporate rather than public interests. The FDA depends on industry funding, creating conflicts of interest in drug approvals. EPA officials move between government and industry jobs, compromising independent oversight.

When regulators are captured, they use corporate-friendly assumptions in safety assessments, delay implementing protective measures, and actively suppress research showing harm. The tobacco industry’s “Operation Berkshire” showed how companies coordinate to influence regulators worldwide. Similar coordination exists across industries today.

Captured agencies also help companies avoid accountability by providing regulatory “safe harbors” that protect against lawsuits. The government indemnity for COVID vaccines exemplifies how regulators actively shield corporations from liability.

Breaking the Cycle: What Real Reform Would Look Like

Ending corporate impunity requires fundamental changes to how we regulate dangerous products and punish corporate killers. Current reforms don’t address the underlying incentive structures that make killing profitable.

Criminal Accountability

Corporate executives who knowingly sell deadly products should face murder charges, not civil penalties. When Ford calculated that 180 deaths were cheaper than an $11 safety fix, executives committed premeditated murder for profit. When Purdue executives marketed OxyContin knowing it was addictive, they created a public health catastrophe for money.

Individual criminal liability would fundamentally change corporate behavior. Executives might calculate that multi-million-dollar fines are cost of doing business, but they won’t risk life imprisonment for corporate profits. Piercing the corporate veil to reach individual decision-makers is essential for deterring future misconduct.

Corporate Death Penalty

Companies that repeatedly kill customers should lose their right to exist. Johnson & Johnson has been poisoning consumers with asbestos since the 1970s while covering up the dangers. Purdue Pharma created the opioid epidemic through fraudulent marketing. These companies are ongoing public menaces that should be dissolved.

Corporate dissolution would transfer assets to victim compensation funds while eliminating the source of ongoing harm. Current bankruptcy schemes allow companies to reorganize and continue operations while shedding liability. True dissolution would end the company’s ability to harm future victims.

Ending Regulatory Capture

Regulatory agencies must be freed from industry influence. This requires eliminating industry funding of regulators, creating permanent cooling-off periods for officials moving between government and industry, and establishing independent oversight of regulatory decision-making.

The FDA’s user fee system should be replaced with public funding that eliminates industry leverage over drug approvals. EPA decisions should be made by officials with no financial ties to regulated industries. Regulatory science should be conducted by independent institutions, not industry-funded researchers.

Victim-Centered Justice

Legal systems should prioritize victim compensation over corporate protection. This means ending immunity schemes that shield companies from liability, eliminating damage caps that limit accountability, and creating victim compensation funds financed by industry rather than taxpayers.

The current system privatizes profits while socializing costs. Companies reap billions from dangerous products while victims receive inadequate compensation from government programs. True justice would require companies to fully compensate everyone harmed by their products, regardless of ability to pay legal fees.

Conclusion: The Price of Corporate Impunity

The “when corporations kill” phenomenon represents the logical endpoint of capitalism without accountability. When companies can profit from death and injury while avoiding meaningful consequences, they will continue choosing profits over people. The Ford Pinto memo from 1973 could have been written yesterday – the same cold calculations, the same disregard for human life, the same corporate immunity from justice.

What makes this especially infuriating is that these aren’t accidents or unforeseeable consequences. These are deliberate business decisions, made by executives who knew people would die and calculated it was cheaper to pay compensation than prevent deaths. The documents are there in black and white: human life reduced to actuarial tables and cost-benefit analyses.

The system perpetuating this carnage isn’t broken – it’s working exactly as designed. Regulatory capture ensures agencies serve corporate rather than public interests. Legal immunity schemes protect companies from accountability while taxpayers bear the costs. Weak criminal penalties make corporate murder a profitable enterprise.

Until we fundamentally restructure the incentives, corporations will continue killing people for profit. The math is simple: if it’s cheaper to let people die than fix dangerous products, corporations will choose death. Only by making corporate murder more expensive than safety will we stop the slaughter.

The victims of Ford Pintos, OxyContin addiction, Vioxx heart attacks, lead-painted toys, asbestos-contaminated powder, Roundup cancer, and COVID vaccine injuries all deserve justice. But more importantly, future victims deserve protection from corporations that view human life as just another entry in their ledger books. The time for half-measures and regulatory theater has passed. Either we hold corporate killers accountable, or they’ll keep killing us – one cost-benefit analysis at a time.

The most damning evidence isn’t conspiracy theories or speculation – it’s the corporations’ own words, preserved in court filings and corporate memos for anyone willing to read them. They tell us exactly what they think human life is worth, and it’s always less than their profits. That’s the ultimate indictment of a system that allows corporations to kill with impunity while counting the money.